Latest Search

Quote

| Back Zoom + Zoom - | |

|

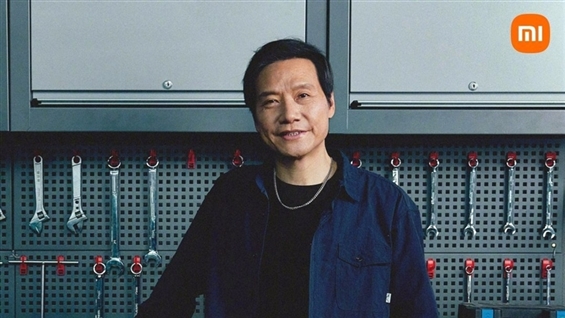

<Research>M Stanley Adds XIAOMI-W (01810.HK) TP to $26 as EV, AIoT Support Growth Prospects

Recommend 25 Positive 49 Negative 11 |

|

|

|

|

Morgan Stanley released a research report raising its 2024/ 2025 revenue forecasts for XIAOMI-W (01810.HK) by 3%/ 2%, and gross profit margin forecasts by 0.7 ppts/ 1.1 ppt, on the back of XIAOMI-W's promising 1H24 results. Morgan Stanley also lifted its earnings forecasts for the same period by 18%/ 13%, respectively. Morgan Stanley believed that XIAOMI-W's better-than-expected performance in EV and AIoT could support the positive growth outlook. Morgan Stanley added its target price on XIAOMI-W from $25.5 to $26, and maintained the stock as its top pick, believing that XIAOMI-W has proved its potential to become a disruptor of the EV industry. The broker expected more positive development in the next 12 months. However, Morgan Stanle was also optimistic on XIAOMI-W's traditional smartphone + AIoT + internet business growth, which may become a catalytic factors for re-rating. AAStocks Financial News |

|